Sri Lanka’s Economic Crisis: Explained

A 70 percent drop in foreign exchange reserves over the past two years has pushed the Sri Lankan economy under its worst economic slump in decades. The drop in reserves has caused a serious devaluation in Sri Lanka’s currency and has made it difficult for Prime Minister Mahinda Rajapaksa's government to pay for essential imports like fuel, food, and medicines.

Limited resources in the region have led to extreme price inflation in essential commodities for the population– leading to a series of protests throughout the island. As a result, the Sri Lankan government has looked to India and China to help with their outstanding debt.

Sri Lanka is also negotiating with the International Monetary Fund (IMF) regarding its $4.5 billion dollars worth of foreign debt that is expected to be paid back by the end of this year. The Indian Express has learnt that India has agreed to assist Sri Lanka in its negotiations with the IMF.

On Thursday, India gave Sri Lanka a $1 billion short-term loan to be used to import food, medicines, and other necessities from India. Alongside the loan, India has also provided a $500-million line of credit to Sri Lanka for oil purchases and a currency swap of $400 million under the SAARC facility, reported The Hindustan Times. Due to India’s intervention with loans, Sri Lanka was able to defer a $515 million payment to the Asian Clearing Union.

China has previously lent billions of dollars to Sri Lanka through its Belt and Road Initiative (BRI) to help build infrastructure projects like ports and a coal power plant throughout the country. In light of Sri Lanka’s recent economic struggles, the island nation has asked China to restructure its debt repayments, giving the country more time to pay off the $3.5 billion they owe to China.

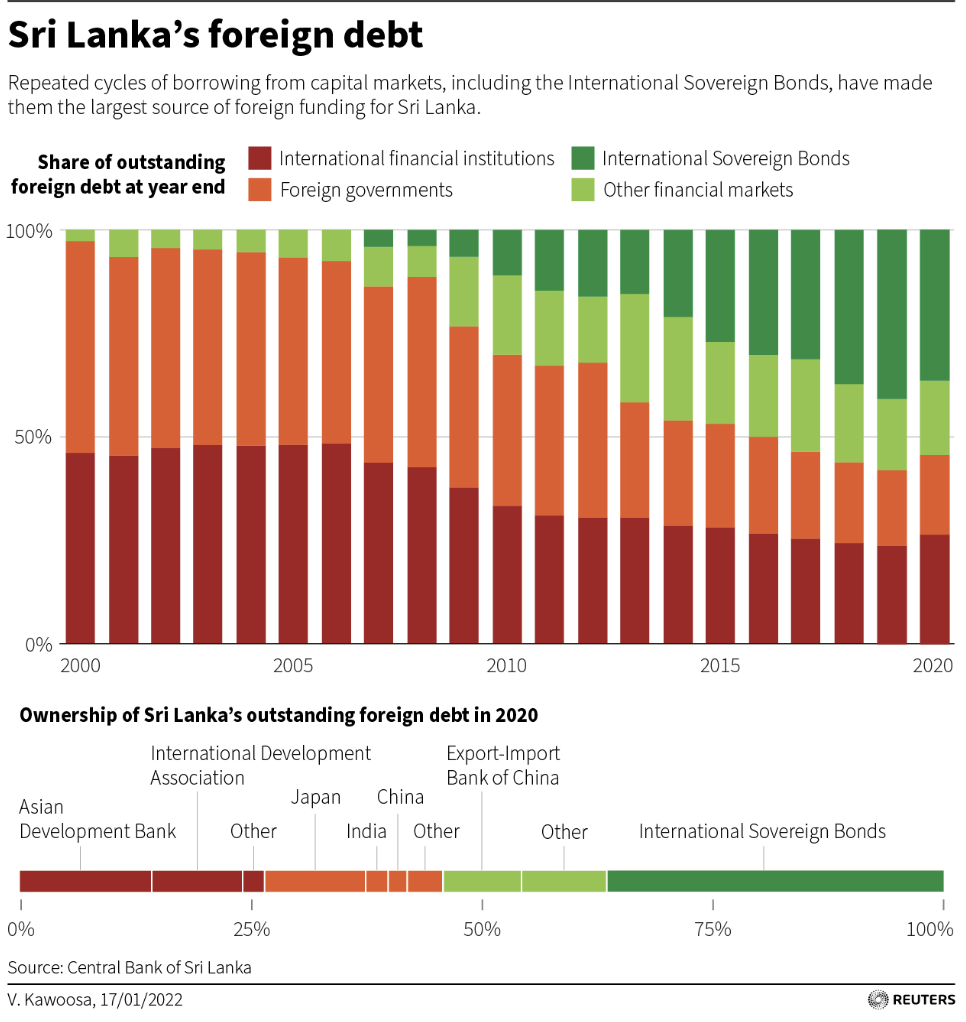

As presented in the graphic above, 36.4% of Sri Lanka’s debt is $11.8 billion in an International Sovereign Bond (ISB) that it has accumulated through repeated cycles of borrowing since 2007, making sovereign bonds its single most source of its debt. Its second-largest creditor is the Asian Development Bank (ADB) with an outstanding loan of $4.6 billion. Japan and China have also each given roughly $3.5 billion to the country, making them Sri Lanka’s third and fourth-largest creditors.

Verité Research Executive Director and Economist Dr. Nishan de Mel told Reuters that with the help of aid Sri Lanka may be able to get out of the situation by restructuring and postponing all their debt repayments, giving them more time to focus on their domestic financial crisis and allowing them to repay debts when they have had time to recover financially.

The Sri Lankan government was particularly hit hard by the pandemic, losing out on its tourism revenue and attempting to recover from poorly time pre-pandemic tax cuts. Since then their economy has rapidly deteriorated, worsening its ability to pay back its debts.

Reuters estimates that Sri Lanka has only $2.31 billion left in reserves.

As Sri Lanka is looking to its neighboring creditors to get out of the severe debt they are in. Aid in negotiating with world banks about other outstanding loans as India has agreed to do will help them deal with their more pressing issues related to good shortages for their population. With the additional aid from India and possibly from China, they hope to get back on track before their financial crisis can worsen anymore.

India’s External Affairs Minister S Jaishankar, who witnessed the signing of their loan agreement, took to Twitter and wrote, “Neighbourhood first. India stands with Sri Lanka.”