China Released Q3 Economic Data after Unexpected Delay

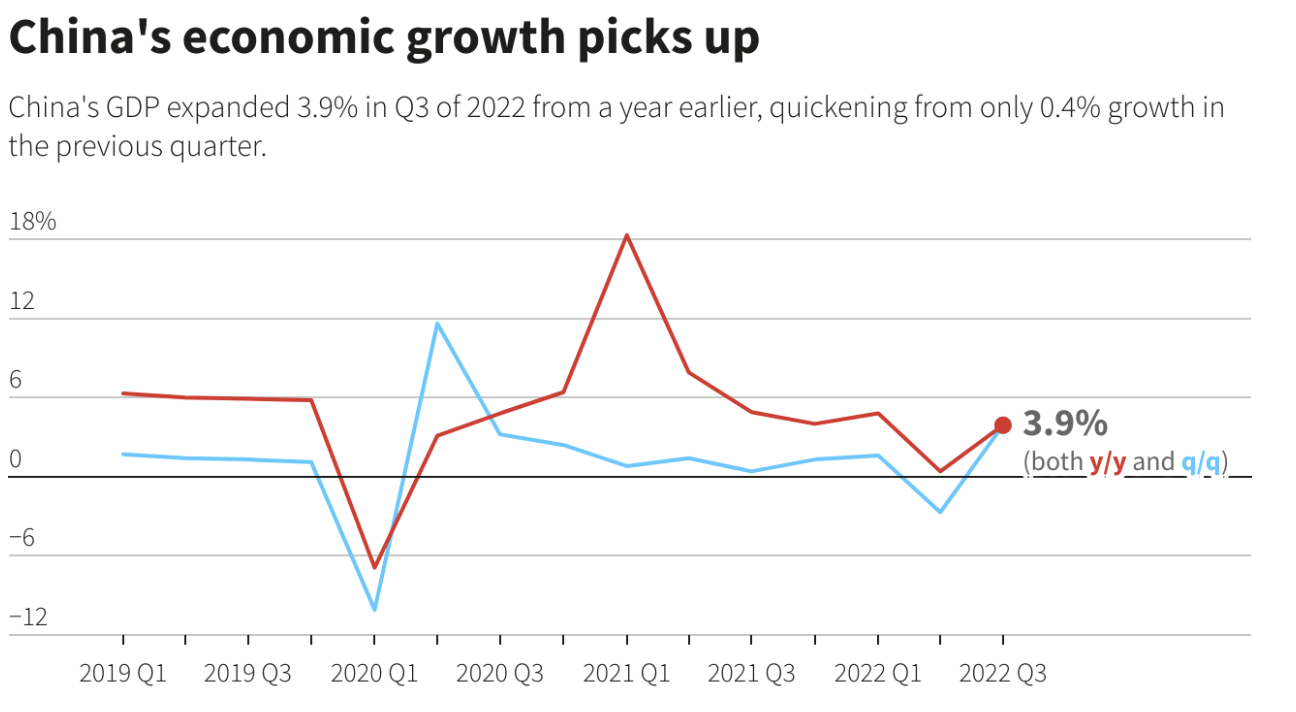

The Chinese economy managed to rebound in the third quarter of this year following an underperformance in the second quarter. Graph: Refinitiv Datastream/ Pasit Kongkunakornkul/ Reuters

On October 24, just one day after the closing ceremony of the 20th National Congress of the Chinese Communist Party, the National Bureau of Statistics of China published the data on the Chinese economy in the third quarter of this year. The data was originally anticipated to be released a week earlier on October 17, but just hours before the set deadline, the Bureau suddenly announced an indefinite delay of the release. According to the newly released data, Chinese gross domestic product (GDP) grew by 3.9% in the third quarter this year compared to last year. This is higher than the rate of 3.4% predicted by foreign economists in a Reuters Poll and the 0.4% in the second quarter, but still lower than the 4.8% in the first quarter. Some other more detailed data on consumption, investment, exports, and other sections is also released.

In an interview in a TV program on CCTV China, a Chinese state-owned broadcaster, Professor Yunchun Liu from Shanghai University of Finance and Economics interpreted the newly released data. According to him, the data is apparently unpretty because China faced three challenges: frequent hot weather, scattered penetration of the COVID-19, and the decline in global economy caused by European and American stagflation. Consumption, though still accounting for the GDP more than investment and exports, declined by 20% compared to last year, while investment grew the most thanks to investments in manufacturing and infrastructure. The next tasks to further boost the Chinese economy, he said, are to stabilize real estate investments, accelerate technological innovation, and encourage the expansion of private enterprises.

According to some analysts, the Chinese economy has some structural issues, of which the housing market bubble is a most typical example. Photo: Raul Ariano/ Wall Street Journal

Professor Liu’s comments are considered too optimistic by some foreign analysts. Clifford Bennett, Chief Economist at ACY Securities, predicted that China’s GDP, on a quarterly basis, would have “a further decline of 1.2%” in the third quarter, which, according to him, is a technical recession the same as the one the US is experiencing now. The data being unpretty may be a reason for its delay, which makes sense “from an image management perspective.” Other journalists predict that a series of other structural problems, including the housing market bubble, may further bear down Chinese economic growth in the following years.

Some Chinese analysts, however, deny the unwarranted connection between the data and politics. As Bruce Pang, chief economist at Jones Lang Lasalle in Hong Kong, explains, "the delayed economic data release is not because of bad economic recovery but the ongoing congress, as authorities want the media and the public to concentrate on the key messages delivered by the big event." Until more information arises on China's economic situation, there will not be an agreement on the conditions that the data and its delay reflect.