Canada Raises Interest Rates as Inflation, Housing Prices Soar

Bank of Canada Governor Tiff Macklem at a news conference. Photo: Adrian Wyld / Bloomberg.

In a bid to quell rising inflation rates, the Bank of Canada has moved to boost interest rates by an additional 0.5%, making it the highest rate hike that the nation has seen in over two decades and demonstrating the measures Canada is willing to take to control its economy.

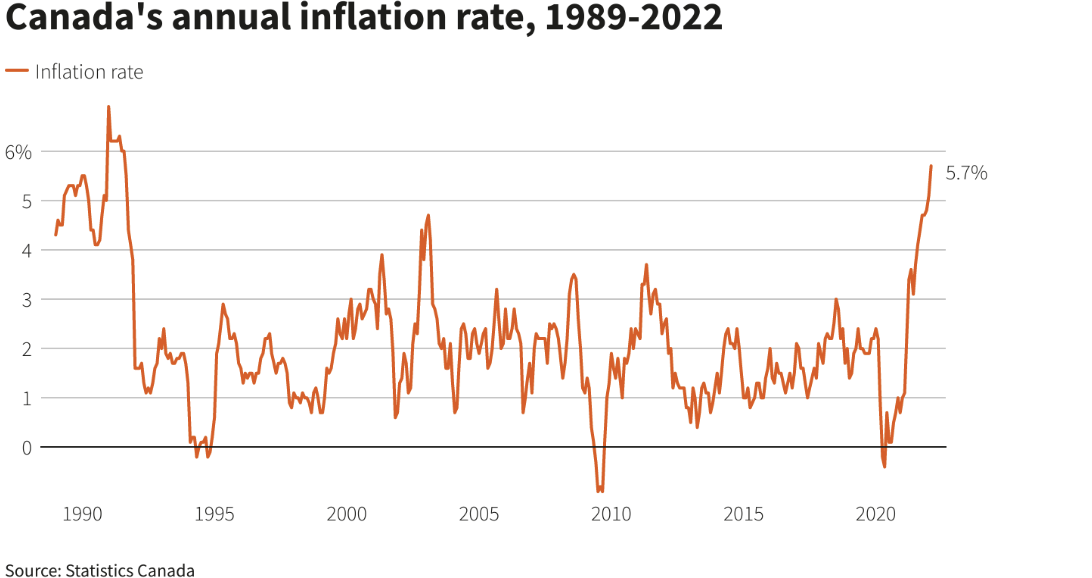

Increased inflation, an apparent universal byproduct of pandemic uncertainty and lingering supply chain issues, has threatened to shake up Canada’s economy. Last month, prices hit a thirty-year high of 5.7%, striking fear among Canadian citizens about the status of their family’s financial stability. Major Canadian banks saw the creeping rates as a sign that interest rates had to be boosted from its original rate of 0.5%.

The April 13 announcement confirms that the Bank of Canada is aiming to take a strong yet gradual approach against inflation. After an initial agreement to raise interest rates from 0.25% to 0.5% on March 2nd, the decision to once again double interest rates has placed the Bank of Canada ahead of other western nations in attempting to control spending.

High interest rates are additionally predicted to have ripple effects throughout the economy. Among the sectors most expected to be hit from the government’s quantitative tightening is real estate, which in recent years has experienced a boom in Canada. Comprising 20% of the nation’s growth in the post-pandemic era, the sector has faced a crisis in attempting to keep pace with the burgeoning housing market.

By ramping restrictions on money borrowing, prospective homebuyers may become more hesitant to purchase houses. It could leave further consequences for those relying on mortgage payments, as increased interest rates will mean higher costs to pay back.

A Reuters graphic of Canadian yearly inflation rates since the 1990s.

Housing prices have already begun to creep down in the aftermath of the initial March rate hike, with national home sales facing a significant decline of 5.4%. Nevertheless, mortgage experts suggest that those on fixed-rate mortgages will be likely unaffected.

Those that depend on variable-rate mortgages, which follow interest rate patterns, should also be able to weather the initial rate hikes due to the institution of “stress tests,” which analyze how homebuyers can handle affordability fluctuations. According to mortgage expert Chase Belair, “You must prove your ability to afford a mortgage at a much higher rate.” This leaves upper-to-middle class families as still the likeliest homebuyers.

Trudeau’s administration has sought to accommodate first-time homebuyers through the rate hike by presenting a series of incentives and tax credits designed to encourage young homeowners in the housing market. The government has also sought to defuse affordability concerns by presenting plans to “double housing construction” and “crackdown on speculation” from foreign buyers.

Canada is still expected to further raise interest rates until a target of 2% inflation is reached. Nevertheless, worries remain that these decisions still do not tackle the main root of inflation — pandemic supply chain woes — and that by instituting harsher monetary measures, the nation might be risking recession.

The Bank of Canada, for its part, has resisted demands to act harsher on inflation. By tailoring an aggressive, yet expected approach for raising interest rates, the Bank hopes to create a flexible approach that avoids shocking the economy. Coupled with government efforts to tackle the housing crisis at its root, Ottawa anticipates that a path towards comprehensive economic recovery is the best outcome in an uncertain economic period.